How Does Personal Accident Coverage Work?

How is your Carnival? How about some more exclusive content from #ModayBlog to relax you and help with your hangover?

The theme content of the month of February at Prospecto was the insurance coverage of Personal Accidents. In all our social networks we shared information, tips and interesting cases about the importance and use of this coverage.

And it couldn't be any different here on our official Blog!

This coverage is very interesting, especially for those of us who work with special risks, such as events and audiovisual productions.

First because it is very important and second because it is mandatory. Several Brazilian states oblige the contracting of this coverage for the public spectator of the event together with the Civil Liability coverage.

Did you know, for example, that in São Paulo there is a specific law that establishes this obligation? Check the law 11.265/02!

In audiovisual productions, hiring is determined by trade unions, such as Sindcine, and production that does not have insurance up to date runs a serious risk of being fined and having its production paralyzed.

Now that we've established why this coverage is critical, let's find out a little more about it.

HOW DOES PA COVERAGE WORK?

As the name already says, the coverage exists to indemnify the insured in the event of an accident, one that causes physical damage, or incapacitates you to perform your duties, and even lead the person to death. .

Take note that, it is only valid if the event is the result of an external, accidental, sudden and unexpected situation, such as slipping in a puddle of water, or falling down a ladder, tripping over wires, etc.

But anyway, how does this coverage work. Simple, let's say you go to an event, a rock concert, for example and you trip when going to buy water, because the event's production did not secure the electrical wires well and as a result, you suffer a sprain in your foot.

Is this situation accidental from an insurance point of view? Yes!

It was something external, beyond your control as an audience, and it hurt you.

PA COVERAGE IS EXPENSIVE?

PA coverage is not usually expensive. It will depend a lot on the length of coverage, the activity carried out, the amounts and sub-coverage contracted. In events, usually AP coverage is contracted only for the duration of the event, if it is for the public. However, if the intention is to cover employees and service providers, the coverage period is slightly longer and is more expensive.

Also obviously, if you take out Accidental Death coverage for R$200,000.00, it will be more expensive than the same coverage with an IS of R$10,000.

WHAT DOES PA COVER?

PA coverage usually covers situations of accidental death, total or permanent disability, medical expenses and, in case of contracting PA Sindcine, death from any cause.

WHAT ARE THE NAMES OF THE COVERAGE AND CONTRACTABLE VALUES?

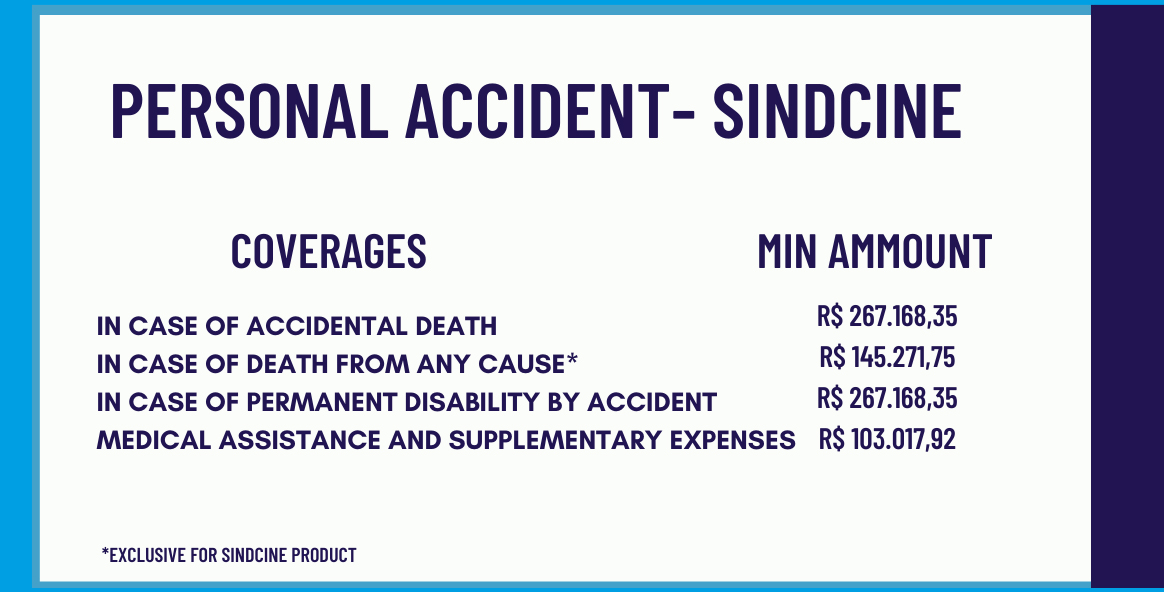

Contractable amounts for PA coverage will vary greatly, depending on the insurer chosen and even the determination of minimum and maximum amounts established by unions, authorities and circumstances. The Sindcine union, for example, determines the amounts to be contracted every year, by agreement, as shown below:

HOW DOES THE COVERAGE WORK IN CASE OF A CLAIM?

Remember our example at the beginning of this text? You had sprained your foot at a rock concert, and we had already established that the situation was an accident and that AP coverage could be triggered.

The first coverage to be triggered is Medical and Hospital Expenses. Usually the production of the event takes you to a hospital, pays for the consultation, exams and medicines and asks the insurance company for reimbursement.

But let's say that even after that first step, you find yourself unable to work, or worse yet, you lose mobility in your foot. Believe me, anything can happen. In a negative situation like this, the other coverages are triggered and you are compensated, up to the contracted limit, depending on the size of the trauma and the extent of the damage.

It may seem absurd, but we know of a filming case, which started with an accident on the film set, of an extra, which ended with the death of the person as a result of the injury.

WHAT IS THE ADVANTAGE OF INCLUDING PA COVERAGE IN MY INSURANCE?

As always, the great advantage lies in reducing the financial impact, after all, this is the main reason why insurance and specific coverage are purchased.

But when we talk about PA at events and filming, for example, PA coverage guarantees almost immediate compensation, while Civil Liability tends to take much longer.

Furthermore, judicially, a company that has been concerned with PA coverage is much more well liked in front of a judge, as it has demonstrated responsibility. Which can be of great help in a large Civil Liability lawsuit.

Did you know that PA is so important and complete?

Don't forget to include this coverage in your next project insurance!

And if you have any questions, we're here for you.

Rest assured, our team is more than ready to answer all your questions!

Protect yourself with Prospecto!

See you on the next #MondayBlog!

Prospecto Seguros

Learn more:

Audiovisual Production

Errors and Omissions

Equipments

Drones

Life and Personal Accidents