What are the salvage and how does subrogation work?

Hello!

#MondayBlog has arrived and with it more information for you, dear reader!

Last week we finished our series “Meet the Members of the Powerful Triad of Audiovisual Insurance” and this September, until the end, we intend to deal with the theme of claims. So if you want to understand a little more about this process, or know about real claims that happened, stay here with us!

To start our conversation about claims, we've brought you a little bit about salvage and subrogation. And we guarantee that by the end of this post, you will have these two terms much clearer in your head.

Since we're talking about claims, maybe it's very normal for you to think that the process boils down to three steps:

1- the damage happens;

2- you inform the insurer and deliver the documents;

3- you are indemnified.

And yes, in briefly terms, that's right. But there are other players that come into action during the claim process, among them are salvage and subrogation.

In short, both salvage and subrogation are ways to help insurers reduce their financial losses, and a way to recover some value with the indemnities paid.

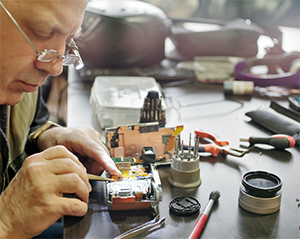

Salvage - where does equipment go after it is damaged and compensated?

Damaged goods or goods that can be rescued from a claim and that still have economic value are called “salvaged”.

A salvage is something that has been saved after an accident. In other words, if your damaged property still has financial value, after the insurer has compensated you for its full amount, it becomes the owner of the damaged property.

What if you don't want to deliver the damaged equipment to the insurance company? Well, in that case, you waive the indemnity.

Few people know that salvage is something the insured accepts as a fact when signing the insurance contract. In exchange for the indemnity, if it is established that you will receive the full amount, the insurer has the right to retain the asset, and do whatever they want with it, as a way of reusing the damaged item.

If you go to London, for example, and visit Axa Re's building, you will find several works of art that are salvages from insurance on the walls of the building.

Axa likes to reuse the damaged works of art, which they have restored temselves, as evidence of how important it is to take out insurance for assets.

The cool thing about salvage is that it becomes a way for the insurer to minimize its losses, but it is also a way to recycle what was damaged.

What is subrogation?

Imagine that you were filming on a road, properly signposted and closed, with all permission from the government, and a car decides to pass the barrier and use the very road you are filming. And in the meantime, this same car, loses control and runs over your camera, almost taking your cameraman with it?

What happens to your insurance?

You call the insurance company and your camera went into heaven of the cameras, so the insurance company will pay your claim normally. But, after that, she will turn all her focus to the person who was driving that car at the beginning of the story, and make that person pay, including in court, if necessary, the entire amount that was indemnified to you!

In other words, subrogation is nothing more than the insurer's right to go after the real person causing the loss and demand from that person the amount due for indemnity.

And, so you ask me, is this very common? Yes, a lot. When the event causing the claim is a third party, it is customary for the insurer to indemnify its insured and pursue the loss with the real cause of the damage.

This happens because the insurer needs to minimize its losses and also because if the accident was not an accident, and if it was not caused by the insured, someone had direct action so that the property was harmed.

So, did you find these two insurance terms that come into play after the accident interesting?

We have had many cases in which the insured does not understand that he is no longer the owner of the damaged property when the indemnity is the cost of the equipment. It often seems logical that you be indemnified, but also keep your equipment. But that would be an illegal profit in the insurance transaction, as the insurance exists to indemnify you for the damage that occurred, but not to give you a profit in case of damage, that is, if you received the indemnity and could also sell the equipment later, the contract would lose the characteristic for which it was created.

The salvage exists, therefore, for the insurer to try to recover the indemnified amount, and it will not profit from it, as it will never get the full amount it paid when indemnifying you.

Next week we continue to talk about claims. Don't miss it!

We're waiting for you for the next #MondayBlog.

Have a great week, lovers!

Prospecto Seguros

Learn more:

Audiovisual Producion

Drones

Equipments

Errors and Omissions

Life and Personal Accidents